Music HR basics is a series of short courses designed to highlight what you need to know about a particular human resource management topic. In today's HR basics, we explore employee discipline and discuss the approaches to the administration of discipline. Discipline is a process of corrective action used to enforce organizational rules. Problem employees are most often affected by the disciplinary system. Fortunately, problem employees represent a small percentage of the workforce in most organizations. However, if managers fail to deal with problem employees promptly, work outcomes are often negatively affected. Effective discipline should be aimed at problem behaviors, not at the employee's personality, because the goal is to improve ance. It's often said that 90% of aggravation for managers comes from 10% of our employees. That is, a small number of employees create the vast amount of disciplinary work for managers. A disciplinary process can demonstrate to employees the organization's commitment to due process and just cause in employment actions. However, managers may be reluctant to use discipline for many reasons. These reasons include an organizational culture of avoiding discipline, lack of support by higher management, fear of loss of friendship, avoidance of time loss, and fear of lawsuits. The two most common approaches to discipline are positive discipline and progressive discipline. Regardless of the approach, certain standards should be applied to the administration of employee discipline. Progressive and positive discipline represent two common approaches to discipline. The positive discipline approach builds on the philosophy that violations are actions that usually can be corrected constructively and without penalty. Progressive discipline incorporates steps that become progressively more severe and are designed to change the employee's inappropriate behavior. Progressive discipline refers to a process by which an employee with disciplinary problems progresses through a series of disciplinary stages until the...

Award-winning PDF software

Disciplinary action for employee misconduct Form: What You Should Know

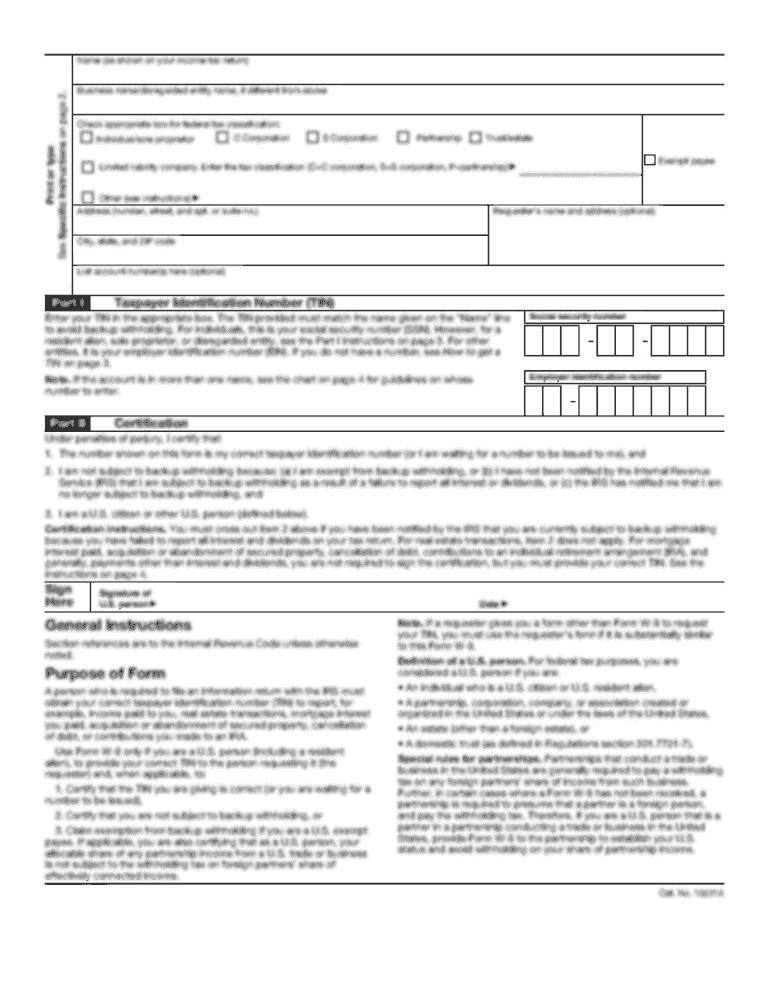

January 20, 2014, 26 CFR Part 1002, Tax Code Section 6501) . The foreign tax requirement is a noncorporate taxable income tax. The domestic tax requirement is a general tax liability, unless the U.S. resident or a U.S. business entity has a noncontrolling income interest. The foreign tax requirement may not apply to U.S. sources' income from U.S. sources. A taxpayer or an entity not claiming a foreign tax credit may elect to use Form 3520 for this purpose. Form 3520 may also be used for any purpose other than a foreign tax credit. The filing requirements and information reporting on Form 5471 are more complex than for most other forms on this page. There is no minimum filing period. You must file Form 5471 to satisfy section 6724(j) when the taxpayer elects the international tax withholding system. The election for the worldwide system of income taxes is also referred to as the withholding system. If the taxpayer fails to file a Form 5471 or does not file a Form 5471 by December 31, 2019, the United States will not have a valid certification of tax compliance for that year under section 6012. If the taxpayer or an agent of the taxpayer fails to file a Form 5471, IRS will not issue a refund of the withheld income tax. The taxpayer may be subject to a penalty under section 6724(a), which imposes an administrative tax on the unpaid amount. The taxpayer must determine whether a Form 5471 is required. Form 5471 can be filed as a standalone information return or as a separate return with Form 7061 for information reporting. Form 5471 is an information return that is required to satisfy section 6724 (j) and section 6662.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employee Disciplinary Action, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employee Disciplinary Action online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employee Disciplinary Action by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employee Disciplinary Action from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Disciplinary action for employee misconduct